Integration can be a competitive weapon that can positively impact the bottom line through encouraging revenue velocity, cost containment, risk mitigation, and long-term customer satisfaction.

Business is moving faster and faster, as customers and business partners demand more automated interactions. IT is no longer supporting the business; it is becoming the core of the business. Digital transformation of businesses requires us to connect and interact with both customers and suppliers in new and unexpected ways.

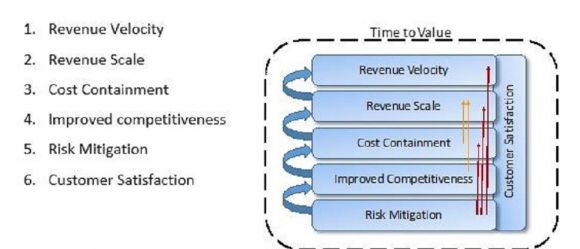

There are six key drivers that guide our efforts in business to push the organization further, and integration can enable and bolster each one. Listed in Figure 1, these drivers have an inherent flow as several build upon previous drivers. All of these drivers are very important to the business in their own ways. They also have an upstream correlation and impact on other drivers.

Figure 1: Key business drivers

It is important to dive deeper to explore how integration could positively impact each of these drivers. I say “could positively impact” because a poor implementation or practice can just as easily have a negative impact on the organization.

Integration, when properly implemented, can introduce process efficiencies and enable data visibility. This impacts and enables each of the key business drivers. As an example, creating an integration that allows sales orders to be submitted electronically reduces processing costs and manual keying errors (cost containment, risk mitigation) and allows for a faster response to processing the order (improved competitiveness), which results in elevated customer satisfaction. It also improves revenue velocity because of the faster processing time, and enables revenue scale that results from the automated processing taking place. Ultimately, this yields a positive time to value for the organization, because more orders can be processed, at a faster rate, with improved revenue receipt timeframes.

Revenue Velocity

Most people would expect revenue growth to be a driver, and it is. But positive revenue velocity can be considered as a direct component indicator that revenue growth is taking place.

Consider a well-managed sales pipeline that closes deals regularly. If data integration (both consumption and/or production) of data streams is part of a deal’s critical path—and generally it is in some fashion, either through the migration process to the new product or assimilation of the product into the existing infrastructure—then a faster solution would reduce the overall implementation cycle time, reducing costs and delivering a completed product/solution to the customer faster. That time savings allows another customer to be serviced, resulting in growth of overall revenue but also allowing revenue recognition to occur faster, yielding both revenue growth and improved revenue velocity.

Revenue Scale

As revenue velocity increases, selling more goods/services is a continuing goal for growth. It’s how we earn our living by helping the company generate more revenue. Where most companies have challenges is in being able to generate revenue “at scale.” What I mean by this is increasing revenue and keeping costs minimal.

In a business-to-business (B2B) setting, many companies have a standard way they want to exchange data, and that’s great if your company is the “800-pound gorilla” in the relationship and can dictate terms. More often, we are not in that position and have to adapt to accommodate new business. So, why not expect this and be proactive? With a little up-front work on our part to create a few formats, we could reap the benefits of adding new business as fast as we can process/onboard it. If we are a little more flexible and support a few formats, it is more likely our customers would recognize that we offer options and are, therefore, “easier to do business with.”

I remember having a discussion with a CIO of a logistics company many years ago, someone I think is visionary in his outlook. He said, “We need to be more like our customers.” What he meant was, he wanted to conduct business in a way that it was a natural extension of his customer. That company had phenomenal growth and became a visible force within its industry, in part because of that elegant perspective. Being the company that is easy to do business with is always a winning strategy.

Cost Containment

Revenue scale and cost containment are, by definition, joined at the hip. Minimizing costs is a component enabler of revenue scale; effective data integration strategies have a direct correlation to cost containment.

Let’s look at a common onboarding use case. Consider a typical organization that operates under a revenue model containing a revenue component based on providing goods or services. Each time a new customer is signed and the process of “onboarding” the customer begins, there are usually several data-related functions that must occur. First, if our company is of any reasonable size, it will likely be exchanging business data electronically with its customers. The business data exchanged is commonly the documents that make up the “order to cash” cycle. These documents are purchase orders, shipment notifications, and invoices. Aside from any unique considerations for the new customer, if the customer can send/receive these documents in the preferred format of our company, then the data onboarding process is reduced to simple testing for accuracy. If the customer cannot work with our data formats, then the process of onboarding them is more involved—read: costs more to make them our customer in resources, time, and human capital.

Improved Competitiveness

If you are happy with your company’s current state, you should put down this article and plan your retirement, with my best wishes. If you are like the rest of us, your competitors are always finding ways to gain advantages in deals and to steal your existing customers.

We all need to be more competitive. Integration abilities could give your firm the edge to get the customer onboarded and active more easily. If your customer is pressured to complete a business arrangement, having your company being the easiest to work with is a significant advantage. And, because you can onboard the customer faster, we see a direct connection to cost containment because you can onboard the customer quickly using existing integration assets, which has a ripple effect back through revenue velocity because you are booking revenue faster and even reaches into revenue scale because your efforts can move on to the next prospect more quickly.

Risk Mitigation

You may have noticed a new term near the end of my explanation of improved competitiveness: integration asset. What I mean by an integration asset is anything that is used during the integration process. This could be a reusable business process to process purchase orders from a certain category of customer (e.g., wholesalers versus direct consumers).

Where this impacts risk mitigation is that once an asset is developed and tested thoroughly, it can be reused. It is a very simple concept, but imagine it at scale in the example above. You may have a business process that accepts, validates, and transforms data for your direct consumer customers. That same process can be used for 100 or 1,000 or 1,000,000 customers. It is a proven process that performs its function flawlessly—and reliably. The only challenge at scale is that you may have to execute hundreds or thousands of transactions simultaneously. Imagine that: one process to manage millions of orders initially entering your system. From a risk mitigation standpoint, once the process is solid, in theory it should always work. (Naturally, this is a simplified example, and there would be a multitude of technology levels at work to make this feasible.) The maintenance costs are dramatically reduced (a direct linkage to cost containment), but the risk of failure of the process is also reduced.

Customer Satisfaction

Our final driver is overall satisfaction of your customer. This is key because initially obtaining a customer and onboarding is, hopefully, the smallest time window of your relationship and revenue generation with the customer. Looking back at the previous business drivers, we see the opportunity for customer satisfaction at each stage of the buyer journey. Given that, customer satisfaction is more of an umbrella driver that is parallel to each of the core five business drivers for integration.

Time to Value

Jonathan Murray, CTO of The New York Times, is an advocate of “time to value.” This new concept creates a metric that can be used to measure IT effectiveness in this new age of digital transformation. He defines time to value as the delta between demand coming in from the business and that demand being satisfied. Given that definition, I like to think of time to value as an umbrella term that encapsulates our key business drivers in one overarching metric.

When we consider time to value further and how it applies to integration, our challenge today is to be able to integrate anything with anything, anywhere, and quickly to deliver value to the business. Basically, the challenge is that, as a business, we need to be able to say one simple word to any valid request that comes our way: yes. It is such a simple, pleasant word, but to reach a position that affords us the confidence and strength to say it, we must look at many aspects of how we conduct business electronically.

Summary

My hope is that I have offered you a different perspective on integration. Some things to remember are that there are no rules, absolute standards, or magic wands and that people are still part of the process. But integration can be a competitive weapon that can positively impact the bottom line through encouraging revenue velocity, cost containment, risk mitigation, and long-term customer satisfaction.

Business users want new applications now. Market and regulatory pressures require faster application updates and delivery into production. Your IBM i developers may be approaching retirement, and you see no sure way to fill their positions with experienced developers. In addition, you may be caught between maintaining your existing applications and the uncertainty of moving to something new.

Business users want new applications now. Market and regulatory pressures require faster application updates and delivery into production. Your IBM i developers may be approaching retirement, and you see no sure way to fill their positions with experienced developers. In addition, you may be caught between maintaining your existing applications and the uncertainty of moving to something new. IT managers hoping to find new IBM i talent are discovering that the pool of experienced RPG programmers and operators or administrators with intimate knowledge of the operating system and the applications that run on it is small. This begs the question: How will you manage the platform that supports such a big part of your business? This guide offers strategies and software suggestions to help you plan IT staffing and resources and smooth the transition after your AS/400 talent retires. Read on to learn:

IT managers hoping to find new IBM i talent are discovering that the pool of experienced RPG programmers and operators or administrators with intimate knowledge of the operating system and the applications that run on it is small. This begs the question: How will you manage the platform that supports such a big part of your business? This guide offers strategies and software suggestions to help you plan IT staffing and resources and smooth the transition after your AS/400 talent retires. Read on to learn:

LATEST COMMENTS

MC Press Online