Mobile enterprise solutions are on the list of priorities for many CIOs in 2012.

Whether the primary focus is to extend your in-house applications to your roaming workforce (B2E) or to interface with customers and prospects (B2C) via mobile devices, or possibly both, the options and considerations are ever-growing.

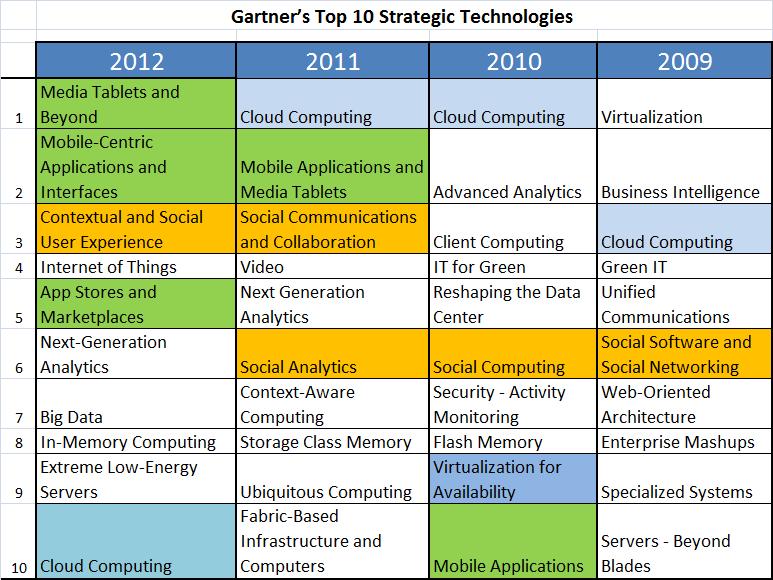

It's no surprise that Gartner's "Top Ten Strategic Technologies for 2012" shows number one and two as "Media Tablets and Beyond" and "Mobile-Centric Applications and Interfaces" with the fifth being "App Stores and Marketplaces." This list is intended to help CIOs who are building their strategic plans and budgets. So, deploying mobile solutions should be a priority for most Information Technology departments. To show how fast this is changing, note that Mobility wasn't even on Gartner's list in 2009 and now it encompasses three of the top five. (See Figure 1 showing the list for the last four years).

Figure 1: What CIOs consider important has changed in the past few years.

In a technology area that is growing (and morphing) at such a rapid pace, there is enormous potential for competitive advantage for organizations with a fast TTM (time to market). Identifying devices, tools, and approaches to integrate your mobile solutions with your current applications infrastructure will be a key step. But it's not just your existing infrastructure and your selected technologies that you have to consider. Employees and consumers are making decisions about what mobile devices and apps they want to work with. Information Technology may not be able to control this, as has been evident with the rapid rise of Apple and Google while previous powerhouse RIM has begun to spiral downward. Individuals, as consumers, have been making decisions about what technology they want to work with.

In 2011, estimates from IDC and Gartner indicate that somewhere between 472 and 491 million new smartphones were sold worldwide. This is an increase of almost 60 percent from 2010. Out of all mobile subscribers in the U.S. and Canada, somewhere between 40 and 50 percent use smartphones, so this market can continue to grow both with new customers and with existing smartphone users replacing current devices with the latest and greatest new smartphones as they come on the market. The research I've read predicts double-digit growth to continue every year for the next three to five years.

CIOs who monitor industry trends for innovations while steadfastly evolving their enterprise systems forward will be the most successful in this volatile technology landscape.

This article explores the options and considerations for building your strategic plan for application mobility. (Note this discussion is not meant to compare robust handheld devices by manufacturers like Intermec, which may be in use for warehouse, manufacturing, and job site applications.)

The Smartphone Battleground

Nothing can demonstrate the volatility of today's technology like the transformation of the mobile marketplace over this past decade. Research in Motion (RIM) was practically the corporate standard for smartphones, but in just a few short years, Android and Apple have stormed in, and Microsoft, in partnership with Nokia, is hot on the trail.

Between 2003 and 2007, RIM's sales grew rapidly from $300 million to $3 billion, peaking at just under $20 billion in revenues for fiscal 2011. A few years ago, Nokia was the top worldwide cell phone (feature phone) provider while RIM's BlackBerry was leading the charge for smartphones. The tide began to turn in a dramatic fashion in 2007 when Apple unveiled the iPhone and Google followed with Android, an open OS that has been adopted by a number of device providers, with Samsung being the largest. The shift is most evident in the U.S., where Neilson (in February 2012) reports 46.3 percent of smartphones are now Android, 30 percent Apple's iOS, and just 14.9 percent RIM's BlackBerry (with Microsoft Windows Phone at 4.6 percent). Data on recent sales indicate that Apple's customer base is still growing, Android is somewhat steady, and BlackBerry is continuing to shrink.

RIM's overall revenue continued to grow on a worldwide basis even as this shift was occurring in North America because of adoption of entry-level models in countries other than the U.S., Canada, and the UK. They are still leading in Latin America and the Caribbean, but the trend in the U.S. is a likely indicator of where the rest of the world is heading.

So where did RIM go wrong? There are numerous articles and blogs online if you want to read the analyses as well as the recent boardroom shenanigans and the predictions about potential acquisitions. A key factor is they did not innovate to meet the market demand but instead continued to upgrade the tried-and-true integrated model. Plus the market demand shifted from a corporate culture to a consumer focus, and at the end of the day, everyone is a consumer. We all started to fall in love with these new gadgets, the touch screens and graphical capabilities, the cool apps, the portal for our music and our pictures and games, integrated social media, video, and more. Yes, of course, email, phone, and messaging were there too. But by now, that's just an assumed function with any mobile device. When the BlackBerry infiltrated the market in the early 2000s, it was the most robust, easy-to-use mobile messaging device around, but with the world of Web and apps and multimedia, the company just followed with the existing interface, and the capabilities lagged behind, in my opinion. Since Apple and Android have hit the scene, there are over 200,000 apps available for each of these platforms while BlackBerry apps are closer to 10,000. So now RIM is playing catch-up with its long-anticipated BlackBerry 10 devices planned for later this year, but it may be too little, too late. Or will they have enough of a loyal base to wait and see?

RIM has huge corporate accounts, but some of them have already announced either changing their device standards or switching to a BYOD (Bring Your Own Device) strategy. IBM is an interesting example of this. CIO Jeanette Horan recently announced that they were moving away from their previous approach to providing everyone with BlackBerries and were moving toward BYOD. Of 440,000 employees, 80,000 of them are now accessing the networks with a BYOD device using IBM's secure computing guidelines.

Meanwhile, Apple is filing patent infringement suits against Samsung's "Android-powered" Galaxy Nexus, which could affect features like predictive text, slide to lock, and Siri-like voice commands. If Apple is able to win any of these injunctions, it could result in barring sales of Nexus in the U.S. until some of these features are removed. (And, as at the writing of this, the Justice Department is charging Apple with price-fixing of eBooks...never a dull moment).

The big questions now are: How will Microsoft Windows Phone fare against iPhone and Android devices? And what will become of RIM? The latest rumour has them acquired this year, with Microsoft/Nokia and Amazon being two of the top contenders. This could become a complete game changer, but in the meantime, Apple and Android are the main players in the battlefield. And of course everyone wants to know what innovation Apple might bring to the table next. Will they announce the iPhone 5 this year or something completely new? Broadcast TV on mobile devices seems to be the next thing.

Tablets

All of the major smartphone players (such as Apple, Samsung, RIM) have released tablets, in addition to Sony, Motorola, HP, and others. Some have already had a short life. For example, HP announced its TouchPad in February 2011, released it in early July, and then announced it was discontinued by end of August 2011. Ironically, by December 2011, in the wake of discontinuing the TouchPad and drastically reducing the price, not to mention enabling Android apps for their tablet, HP was able to sell out its inventory with over 903,000 units sold in 2011.

Unlike the smartphone battle, which continues to rage on, there doesn't seem to be much question about who has been winning the tablet wars. Apple's iPad is clearly the king, and it was also the first to market. Time magazine named the iPad, released in April 2010, "one of the 50 Best Inventions of the Year 2010." In 2010 alone, Apple sold 14.8 million iPads (which is now similar to their quarterly sales), and they haven't had to discount them to accomplish this. They consistently have held 70-75 percent of the U.S. share of the tablet market, and with the recent release of iPad 3, the frenzy has continued.

iPads are not only in use by consumers to read books, play games, listen to music, surf the Web, manage and capture multimedia objects like pictures and video, and communicate with friends and family. They have also been taken up by business. Countless case studies on iPad use in the medical and legal fields, as well as significant productivity gains for the roaming workforce for business, are already published. Educational applications for homeschooling and distribution of eBooks for textbooks and assignments are also a large opportunity. But even while this uptake for business continues, Apple remains focused on the needs of the individual consumer, as has always been the case.

The PlayBook was released in 2011 with an OS based on "QNX Neutrino," the first example of the new BBX operating system that is now referred to as BlackBerry 10, currently scheduled for release on smartphones in late 2012. Apps for the PlayBook were initially developed using the BlackBerry API with Java, but RIM has recently announced support for Android apps via the BlackBerry App World store, which will dramatically increase the available apps for their platform. Like HP, RIM's sales were sluggish and only picked up when they heavily discounted the price. By end of 2011, the Playbook had sold something like 800,000 units. Unlike the other tablets, the PlayBook is uniquely targeted to BlackBerry users as it pairs with the smartphone for email and calendar functions. With approximately 60 million BlackBerry subscribers, RIM had expected a much larger uptake than has been received to date and ultimately had to take a $485 million write-off to account for the deep discounts and poor sales.

If you visit your local consumer electronics superstore, you will see a wide range of tablets available for sale now in different sizes and price ranges. Most of the tablets on display will be running a version of the Android OS. You may see a couple with Windows 7, and of course, the iPad and PlayBook will each have their proprietary OS with their proprietary hardware. The Android tablet devices have not gained a foothold in business applications yet, as the iPad seems to have.

Varsity Spirit iPhone Application Roll-Out

Before we review mobile application options, here's an example of a company that has successfully deployed an iPhone solution to their sales team.

If you've been involved with cheerleading, then you are probably familiar with Varsity Spirit (www.varsity.com). They are the driving force for cheerleading, comprised of the leading organizations and brands in the various cheerleading segments, including its educational camps and clinics, competitions, and uniforms.

They have over 300 sales representatives who visit cheerleading groups at various schools—elementary, high school, and college. In the past, sales reps had to connect to green-screens on the IBM i using laptops to check inventory availability when they were meeting with their clients. Sometimes, they weren't able to connect, and pulling out the laptop was cumbersome and not always viable.

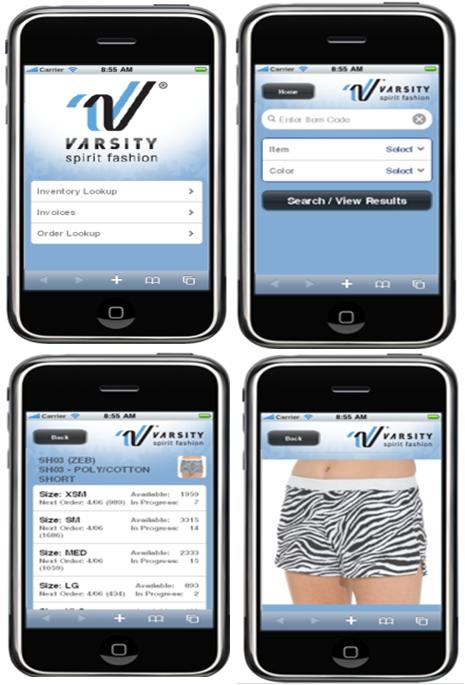

In December 2010, the sales staff all received a Christmas present from Varsity: new iPhones to replace their BlackBerries. And just one month later, the first phase of the new sales mobility application was rolled out. They have been steadily adding features to it ever since. A few screenshots of the iPhone solution are shown in Figure 2.

Figure 2: Varsity's iPhone app offers employees tons of functionality.

Don Corzine, the IT Applications Manager for Varsity Brands, says the sales reps were thrilled with the new iPhone app. "Now they can check inventory, search on items, show pictures of selected items, and request reprints of invoices from their iPhones even if they meet with their customer in the middle of a stadium," he said. "It's a definite improvement to both sales productivity and customer service."

Mobile Applications

Apps and the evolution of the online marketplace have been a key part of the buzz around mobile computing. Apple set the stage with iTunes first for music and then for apps, books, videos, and more. Apple's App Store "sold" its 25 billionth app recently. Google Play (formerly known as the Android Market) has over 13 billion downloads, and the BlackBerry AppWorld about 2 billion. Other emerging online marketplaces for apps include the Amazon AppStore and Windows Phone Marketplace.

Social media and games make up a significant portion of these apps, but they can be developed and deployed for business use as well. Generally, the ability to launch an app from the mobile interface instead of via a browser is more desirable by today's users. The other benefit is the ability to interface with the device to take advantage of special capabilities like location information and using the camera for functions like capturing pictures or barcode scanning.

The challenge with deploying business apps will become apparent if you allow the BYOD concept for employees or you try to provide a service to customers and have a variety of different devices to support. Apps run natively on the devices, so the underlying technology and language used to develop them differ. For example, Objective C is used for Apple's iOS, but it's Java for Android. There are also a number of development tools and options for developing these apps that will generate the lower-level code.

Web deployment to smartphones and tablets is also a viable approach for enterprise applications. HTML5 is the emerging standard for Web development, especially for multimedia and mobile applications with many new and evolving features to support the new capabilities.

With enterprise application deployment, a browser solution has many advantages, especially if multiple device types must be supported. However, users—especially if they are your customers—may demand apps, so another way to address this is via a hybrid approach. In this scenario, you may develop and deploy the majority of the business application via the Web but have a custom-built container app running on the devices to launch the Web app. In this way, the users may not even realize that they are in fact working with a browser application. This is actually how the Varsity iPhone solution works. aXes (from LANSA) was used over the IBM i application, and then a container app was built to launch the Web interface.

Developing Your Mobile Strategy

In terms of enterprise mobile deployment, two changes are occurring in the corporate world with respect to devices. The first is the obvious one: business and IT are standardizing on and replacing their employees' mobile devices with the latest smartphones, most commonly Apple or Android in the last couple of years.

The second situation demonstrates how this revolution occurred in the first place. Apple products have always been focused on the individual rather than the corporation. And it's the individual preferences that are changing what IT must support in some organizations. BYOD, as with the IBM example, where the employees will bring whatever smartphone they prefer and IT will deploy applications to it, may also be a direction for your organization.

With respect to mobile applications, organizations are rolling out employee productivity apps (such as the Varsity Spirit iPhone solution for sales reps) that involve a number of decisions, including whether to focus on native app development, or Web apps, or some combination of the two. Some of the considerations that will help you to determine your desired approach and related tools will include identifying your target users, their preferences, the type of devices you need to support, performance, security, degree of integration to your enterprise systems, the need to access device functionality such as the camera or GPS/location, whether the app can be run offline, how frequently the app will change, and so on.

While it will be a tremendous milestone to make these decisions, identifying your target devices and the method /tools for delivering your apps is only the beginning. For many, server-side development and integration with enterprise systems, as well as developing your mobile security plan, will be key. Once your enterprise begins to incorporate "mobile computers" (whether they are smartphones or tablets) to your business, you'll also need to address application delivery and access to data from your enterprise systems, as well as file sharing and storage between mobile devices and desktops and/or servers. This could involve storing and synchronizing of files that may have originated on PCs, like spreadsheets and documents. Cloud services like DropBox and iCloud are examples of popular online services for this. LongReach is an example of an enterprise hosted solution to accomplish this from your IBM i.

Wrap-Up

So, planning and executing your organization's strategy for application mobility—involving apps for employees, partners, and customers—with back-end integration to your enterprise systems from smartphones and tablets is likely to be a priority for 2012 and beyond if the analysts have it right.

When assessing market trends with smartphones and tablets, the statistics and analyses can sometimes be confusing. For these trends, we can review overall subscribers in the U.S. or worldwide, and we can assess units sold last quarter or last year and in different regions. We can also assess how many apps are available on each platform and how many have been downloaded to date. We can look at surveys and predict buying behaviors of both corporations and individuals for the coming year. And, of course, we can look at the main players and see if their market share and revenue has been increasing or decreasing and what might be coming in their portfolios to affect this. Add to that the fact that we can often use stats to paint different pictures of the same situation; it can get confusing with so many articles, blogs, and reports online.

However, here are a few statements that seem to be corroborated by the majority of the analysts, regardless of which statistic they're quoting:

RIM BlackBerry, once the darling of the smartphone era, is losing ground fast. First Apple and now Android have emerged with products that are capturing the U.S. market and are on their way internationally. Everyone is watching the new Microsoft/Nokia Lumias/Windows Phone offering to see if it can catch up. Microsoft, Amazon, and even Samsung are rumored to have looked at the possibility of acquiring RIM. Meanwhile, Apple is the most valuable tech company in the world, due largely to innovative products such as the iPhone and the iPad and their online App Store.

Although I recently made the switch from BlackBerry to iPhone and have also recently acquired a new iPad 3, I have to admit that I am rooting for RIM to survive. (I've always had a soft spot for the underdog). Like many others, I went from one BlackBerry to another for over 10 years. I even paid full price for a BlackBerry PlayBook last year before I finally abandoned ship. After all, I'm not only Canadian but I'm also an alumnus of the University of Waterloo, which is home to Research in Motion. But I'm not holding my breath. And I'm going to continue to enjoy the super cool capabilities of my iPhone and iPad, although, being a techie at heart, the closed/iTunes method for managing the devices can be frustrating at times.

In the myriad of decisions that you will need to make, just make sure you plan for change. Because that is one thing you can be certain of in this volatile mobile world.

Business users want new applications now. Market and regulatory pressures require faster application updates and delivery into production. Your IBM i developers may be approaching retirement, and you see no sure way to fill their positions with experienced developers. In addition, you may be caught between maintaining your existing applications and the uncertainty of moving to something new.

Business users want new applications now. Market and regulatory pressures require faster application updates and delivery into production. Your IBM i developers may be approaching retirement, and you see no sure way to fill their positions with experienced developers. In addition, you may be caught between maintaining your existing applications and the uncertainty of moving to something new. IT managers hoping to find new IBM i talent are discovering that the pool of experienced RPG programmers and operators or administrators with intimate knowledge of the operating system and the applications that run on it is small. This begs the question: How will you manage the platform that supports such a big part of your business? This guide offers strategies and software suggestions to help you plan IT staffing and resources and smooth the transition after your AS/400 talent retires. Read on to learn:

IT managers hoping to find new IBM i talent are discovering that the pool of experienced RPG programmers and operators or administrators with intimate knowledge of the operating system and the applications that run on it is small. This begs the question: How will you manage the platform that supports such a big part of your business? This guide offers strategies and software suggestions to help you plan IT staffing and resources and smooth the transition after your AS/400 talent retires. Read on to learn:

LATEST COMMENTS

MC Press Online